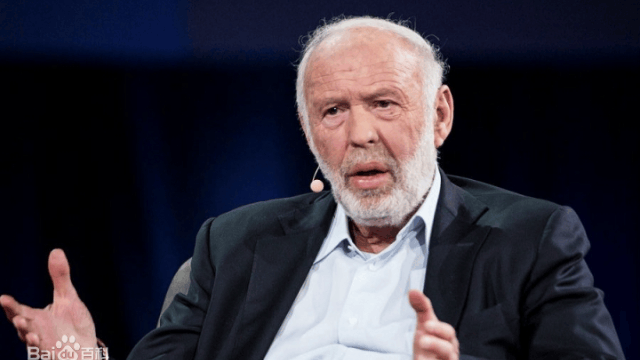

James Simmons aspired to be a mathematician. Simmons has described his love of mathematics and logical reasoning from an early age, and at the age of 14 he got a temporary job over the Christmas holidays managing the stockroom of a gardening equipment shop. But it wasn't long before the shop sent him off to sweep the floors because he repeatedly forgot about the stock. At the end of that holiday, Simmons told his colleagues at the shop that he wanted to study mathematics at the nearby Massachusetts Institute of Technology (MIT), to which he was ridiculed by his boss.

But with excellent test scores and a recommendation from a high school mentor, Simmons got what he wanted. After graduating from MIT, he went on to earn a PhD from the University of California, Berkeley, and at the age of 24, he became a professor of mathematics at Harvard University.

Not content to rest on his laurels, in 1964 Simmons joined the Defence Logic Analysis Association, a non-profit organisation under the US Department of Defense, to work on code breaking. I went to the Defense Research Institute at Princeton University, where the people were doing classified government work and were paid so well that you could spend half your work time working for them and the other half on your own mathematical research," he recalls. "

This was undoubtedly the most desirable state of affairs for an academic, but the good-natured man was surprisingly obstinate and got into an argument with his superiors over an article published in the magazine pages of the New York Times by retired four-star Army General (Simmons' superior) Taylor, defending US involvement in the Vietnam War, which Simmons then publicly opposed in an article in the Times for his support of the war.

He then returned to academia. In 1976, Simons co-founded the famous Chern-Simons theory with the renowned Chinese mathematician Chen Shoushin, which won the prestigious Chern-Simons Theory, the highest honour in mathematics awarded every five years. In 1976, Simons co-founded the famous Chern-Simons theory with the famous Chinese mathematician Chen Shoushin and won the Veblen Prize, the highest honour in mathematics, which is awarded every five years.

Simons then turned to finance, opening Limroy, a private investment fund, in 1978, and five years later founding Renaissance Technologies and launching the company's flagship product, Medallion Fund. At the start of his career, Simmons also chose to trade fundamentals. In the subsequent application of the model to his investment practice, Simmons found that the return on his investments increased day by day, with investors' money becoming 12 times what it had been at the start, net of other fees. Simmons then recruited a well-known mathematician, a colleague from his days at Stony Brook University in New York State, to grow the model team. Over the next few years, Simmons combined fundamental trading, venture capital and all other investment approaches and continued to create new and more effective models.

Slowly, Simmons began to abandon fundamental trading, once stating: "I'm Mr. Model and don't want to do fundamental analysis; one of the advantages of a model is that it reduces risk. And by relying on personal judgement in picking stocks, you can get rich overnight or you can lose it all again the next day."

It was in 1988 that Simmons began to rely 100 per cent on model trading. The Grand Prix Medallion fund came out of nowhere. Traditional qualitative investing is a process where the fund manager uses fundamental analysis research as the core foundation, researching listed companies, checking management and shareholder communication, and learning to master various research reports, a process akin to F10 in stock trading software. the final landing is based on the fund manager's personal subjective judgement.

Quantitative investment, on the other hand, uses computers to help the human brain process large amounts of information. Firstly, a large database is used for screening, and then the investment ideas or concepts are reflected in the model through the design of specific indicators and parameters, according to which the market is tracked and analysed without any subjective emotions, and the investment is selected with the help of the computer's powerful data processing capabilities.

When an order is placed, the trader captures fleeting opportunities with thousands of quick intraday short trades, sometimes accounting for up to 10% of the entire Nasdaq trading volume. However, when the market is in extreme volatility and other special moments, the trading switches to manual.

Eventually, Simmons opened up a completely different way of trading from Warren Buffett's "value investing" through "model" investing, relying on mathematical models and computers to manage his huge fund, using mathematical models to capture market opportunities and computers to make trading The computer makes the trading decisions.

Although his investment record is impressive, Simmons' success is difficult to replicate as not every investor is also a world-renowned mathematician, which makes Simmons' achievement all the more unique.