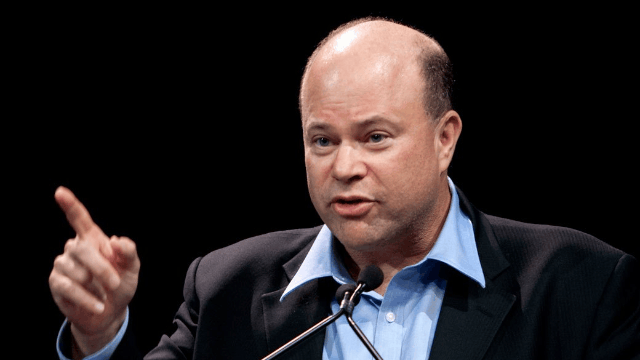

Since his childhood, Tepper has shown an extraordinary talent for investing. As a child, he was a keen collector of investment-worthy 'baseball cards' and could not forget the information on the players on them. In high school, he began assisting his father in investing in low-priced stocks. While at the University of Pittsburgh, Tepper developed a system for running trading decisions to earn pocket money and complete his studies in economics, and by the age of 25 he had earned an MBA from Carnegie Mellon University.

In 1985, Tepper joined Goldman Sachs and worked there for eight years. During that time his main responsibility was to focus on companies that were underperforming or on the verge of bankruptcy. During the 1980s, when junk bonds were booming, Tepper's department performed well and became one of Goldman's most profitable businesses. And when the junk bond market crashed in 1989, Goldman Sachs reaped huge rewards as the market emerged, thanks to Tapper's decisive purchases of troubled bank bonds.

One of Tepper's classic investments early in his career was the purchase of preferred shares in Algoma Steel. The latter had filed for bankruptcy protection in 1993 and, after detailed research, Tepper discovered that the company's preference shares were in fact the company's first-tier mortgage bonds, collateralized by the company's plant and headquarters. Tapper made a quick decision to buy these preference shares at 20 cents per share and subsequently sold them within a year at 60-80 cents per share.

In 1997, when the South East Asian financial crisis hit and the Korean won plummeted by 50%, Tapper 'bottomed out' by buying Korean won futures and Korean government bonds, with his fund making a 30% return that year. 2001, also investing in junk bonds, Tapper's fund made a 61% annual return.

The 'rag-picker' style of investing, which had long been on the fringes of Wall Street, is now attracting a lot of attention under the light of Tepper's huge success. Some insiders believe that Tepper's ability to remain calm and level-headed in a market environment full of fear and misinformation has allowed him to pinpoint investments that are not favored by the market but have potential value.

Tapper's greatest success came in 2009. At the time, the market was still in fear of the financial crisis and US bank stocks had suffered a massive sell-off and share price losses due to the distress. Yet instead of heeding the market's pessimism about some of the larger banks, Tepper focused on the US Treasury's statement about supporting large financial institutions. The US Treasury was committed to buying up the banks' preferred shares, which were converting at a price much higher than the market price of common shares at the time, and had repeatedly stressed that it would not nationalize these banks.

With this in mind, Tepper became the largest buyer of bank stocks in the market at the time when he began a major buying spree in early 2009 of shares in Bank of America, Citi and American International Group (AIG), which had been abandoned by the crowd. According to Tepper later, the average cost of his Citigroup shares was $0.79 and Bank of America shares cost $3.72. By the end of 2009, Citigroup and Bank of America shares had soared 233% and 330% respectively.

Not only that, but the AIG bonds that Tepper had bought at 10 cents in early 2009 had soared to 61 cents by the end of the year. By the end of 2009, Tapper's fund had earned $7 billion from betting on bank stocks, a return of 120 per cent. As a result of his outstanding performance, Tepper's annual personal income reached US$4 billion.

According to Tapper's former colleague Jonathan, Tapper had a vision for things and could make small choices based on his view of the future, such as picking a particular stock, "He would buy investments that reflected his macro expectations."

Tepper left Goldman Sachs in late 1992 and the following year co-founded Appalosa Management with another Goldman Sachs junk bond trader, Jack Walton. In its first year of existence, the firm's assets under management grew significantly from $57 million at its inception to $300 million. By now, the firm has $20 billion in assets under management.

In a hedge fund career spanning almost 20 years, Tepper and his funds have consistently delivered exceptionally high returns, becoming a new benchmark in the hedge fund industry. Last year, Appaloosa Investment Management celebrated its 20th birthday with a net return of 28.44% over the past two decades.

Appaloosa's outstanding performance has placed Tepper among the greatest hedge fund managers on Wall Street and has been a regular on Alpha Magazine's ranking of the top-earning hedge fund managers in recent years. in 2007, Tepper was ranked the 9th most profitable hedge fund manager by Alpha Magazine with $670 million in annual revenues. in 2010, he was named by Alpha Magazine with $4 billion in annual revenues as highest paid hedge fund manager of 2009. On the latest Forbes list of the world's richest people, Tepper, 56, is ranked 130th with $10 billion.

The US stock market rose sharply last year, with the Standard & Poor's 500 Index up 32 per cent, while the hedge fund industry fared poorly in comparison, with an overall return of less than 9 per cent. But in these market conditions, Palomino Fund, Appaloosa Management's main investment vehicle, posted a net return of more than 42 per cent last year, well ahead of its peers. During the year, Tapper topped Institutional Investor magazine's list of the richest hedge fund managers with $3.5 billion in revenue.